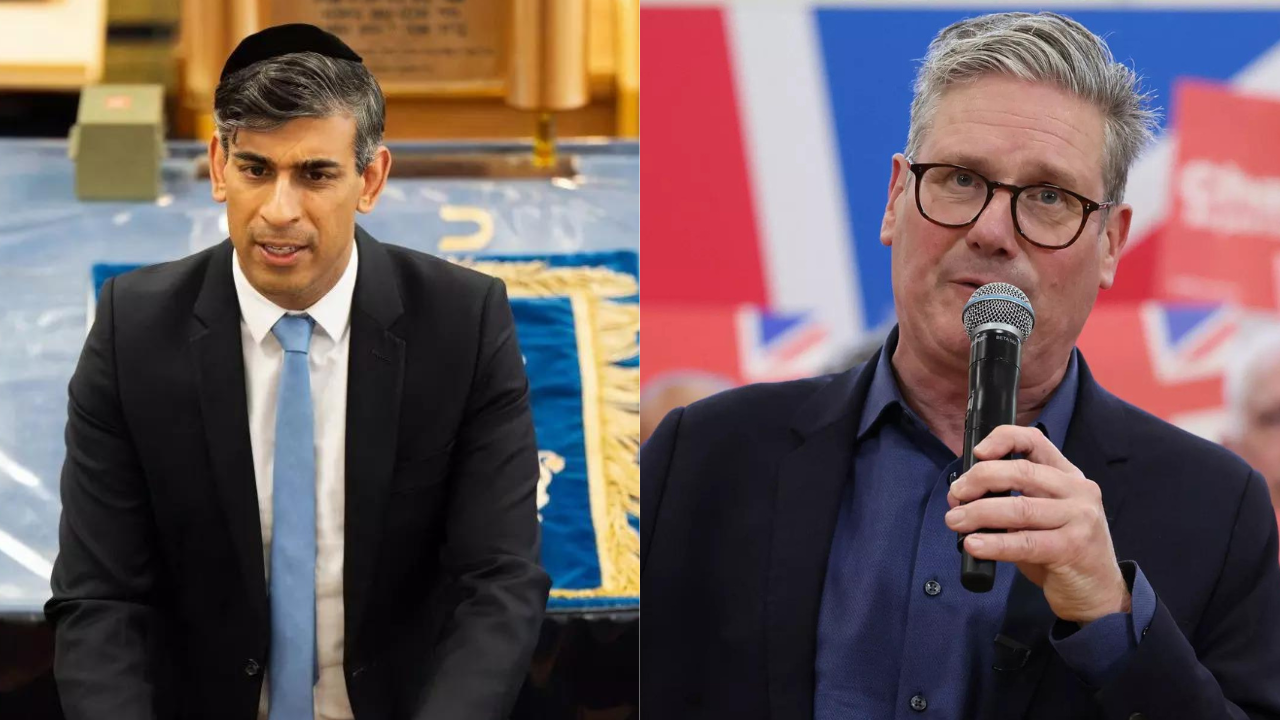

The UK general election is set to bring about the first change in government in 14 years. According to the exit poll conducted on election night, Prime Minister Rishi Sunak and his Conservative Party are likely to experience a crushing loss.

As the votes are being tallied, early indications suggest that Labour has taken a commanding lead, potentially setting the stage for a change in the nation’s political landscape.

Credit rating agencies that downgraded the UK’s rating after Brexit and the market turmoil caused by Liz Truss in 2022 have raised several concerns that require attention from the new government.

High debt-to-GDP ratio

One major issue is the UK’s high debt-to-GDP ratio, which is close to 100%. While all parties have pledged to improve public services and invest in infrastructure without increasing key taxes, the market reaction to Truss’s spending plans serves as a cautionary tale against radical measures. S&P Global highlighted the importance of balancing revenue and expenditure adjustments to improve the underlying fiscal position.

Economic growth challenges

Another concern is the UK’s sluggish economic growth, averaging just 1.6% annually over the past decade. Fitch Ratings, which raised its outlook on the UK’s AA- rating to “stable” in March, notes that the country’s debt-to-GDP ratio is more than double the median for ‘AA’ bracket countries. Boosting growth will be challenging due to factors such as net migration, labour market participation, and productivity growth issues.

Fiscal rules and debt management

The new government will also need to consider whether to modify the UK’s self-imposed fiscal rules, which mandate a reduction in public sector debt as a share of GDP over a five-year period. While some Labour officials have suggested that significant reforms are currently off the table, the government faces substantial debt issuance and interest payments in the coming years.

Pound as a global reserve currency

Scope, a European-based rating firm, highlights the importance of maintaining the pound’s status as a global reserve currency. “A stable government managing credible budgetary policies” and “enhancing access to the (EU) Single Market” are seen as key factors in preserving this status.

Sewage crisis

Finally, the issue of raw sewage discharge by privatised water companies has become a prominent election topic. If these companies fail to invest in solving the problem, the government may need to intervene and run them, adding to the UK’s debt burden. While this alone may not be enough to change the UK’s rating, it could contribute to a confluence of factors that could impact the country’s credit assessment.

(With Reuters inputs)

As the votes are being tallied, early indications suggest that Labour has taken a commanding lead, potentially setting the stage for a change in the nation’s political landscape.

Credit rating agencies that downgraded the UK’s rating after Brexit and the market turmoil caused by Liz Truss in 2022 have raised several concerns that require attention from the new government.

High debt-to-GDP ratio

One major issue is the UK’s high debt-to-GDP ratio, which is close to 100%. While all parties have pledged to improve public services and invest in infrastructure without increasing key taxes, the market reaction to Truss’s spending plans serves as a cautionary tale against radical measures. S&P Global highlighted the importance of balancing revenue and expenditure adjustments to improve the underlying fiscal position.

Economic growth challenges

Another concern is the UK’s sluggish economic growth, averaging just 1.6% annually over the past decade. Fitch Ratings, which raised its outlook on the UK’s AA- rating to “stable” in March, notes that the country’s debt-to-GDP ratio is more than double the median for ‘AA’ bracket countries. Boosting growth will be challenging due to factors such as net migration, labour market participation, and productivity growth issues.

Fiscal rules and debt management

The new government will also need to consider whether to modify the UK’s self-imposed fiscal rules, which mandate a reduction in public sector debt as a share of GDP over a five-year period. While some Labour officials have suggested that significant reforms are currently off the table, the government faces substantial debt issuance and interest payments in the coming years.

Pound as a global reserve currency

Scope, a European-based rating firm, highlights the importance of maintaining the pound’s status as a global reserve currency. “A stable government managing credible budgetary policies” and “enhancing access to the (EU) Single Market” are seen as key factors in preserving this status.

Sewage crisis

Finally, the issue of raw sewage discharge by privatised water companies has become a prominent election topic. If these companies fail to invest in solving the problem, the government may need to intervene and run them, adding to the UK’s debt burden. While this alone may not be enough to change the UK’s rating, it could contribute to a confluence of factors that could impact the country’s credit assessment.

(With Reuters inputs)